UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 | | | | | | | | |

Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

| Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

| | | | | | | | |

| OptiNose, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check all boxes that apply): |

| ý | No fee required. |

| o | Fee paid previously with preliminary materials. |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

NOTICE OF 20232024 ANNUAL MEETING

OF STOCKHOLDERS AND PROXY STATEMENT

Meeting Date

June 8, 20236, 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON JUNE 8, 2023:6, 2024:

This Notice of Annual Meeting and Proxy Statement, the accompanying form of proxy card, and our Annual Report for the year ended December 31, 20222023 are first being sentmade available to stockholders electronically via the Internet on or about May 1, 2023. In addition, a complete setApril 26, 2024, in connection with the solicitation of the proxyproxies on behalf of our Board of Directors for use at our 2024 Annual Meeting of Stockholders, to be held on June 6, 2024 at 8:30 a.m., Eastern Time (the Annual Meeting). These materials are available on the Internetto holders of record of our common stock at www.proxyvote.com, where you will be asked to enter your sixteen digit control number provided in the Notice of Internet Availability of Proxy Materials in order to access such materials, and our website, www.optinose.com.

Whether or not your plan to attend the Annual Meeting, please follow the instructions on the Notice of Internet Availability of Proxy Materials so that your shares may be voted at the Annual Meeting. If you attend the Annual Meeting, you may revoke your previously-submitted proxy and vote during the Annual Meeting.

| | | | | |

| | Page |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| EXECUTIVE COMPENSATION | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

________________________

In this Proxy Statement, the words “Optinose,” “the Company,” “we,” “our,” “us” and similar terms refer to OptiNose, Inc. and its consolidated subsidiaries, unless the context indicates otherwise.

OPTINOSE®, XHANCE® and the Optinose logo are trademarks of ours in the United States. Other trademarks, trade names and service marks appearing in this Proxy Statement are the property of their respective owners.

1020 Stony Hill Road, Suite 300

Yardley, Pennsylvania 19067

(267) 364-3500

NOTICE OF 20232024 ANNUAL MEETING OF STOCKHOLDERS

The 20232024 Annual Meeting of Stockholders (Annual Meeting) of OptiNose, Inc. (Company, we, us, and our) will be held on Thursday, June 8, 20236, 2024 at 8:30 a.m., Eastern Time, at the offices of OptiNose, Inc., 1020 Stony Hill777 Township Line Road, Suite 300, Yardley, PA 19067, for the following purposes:

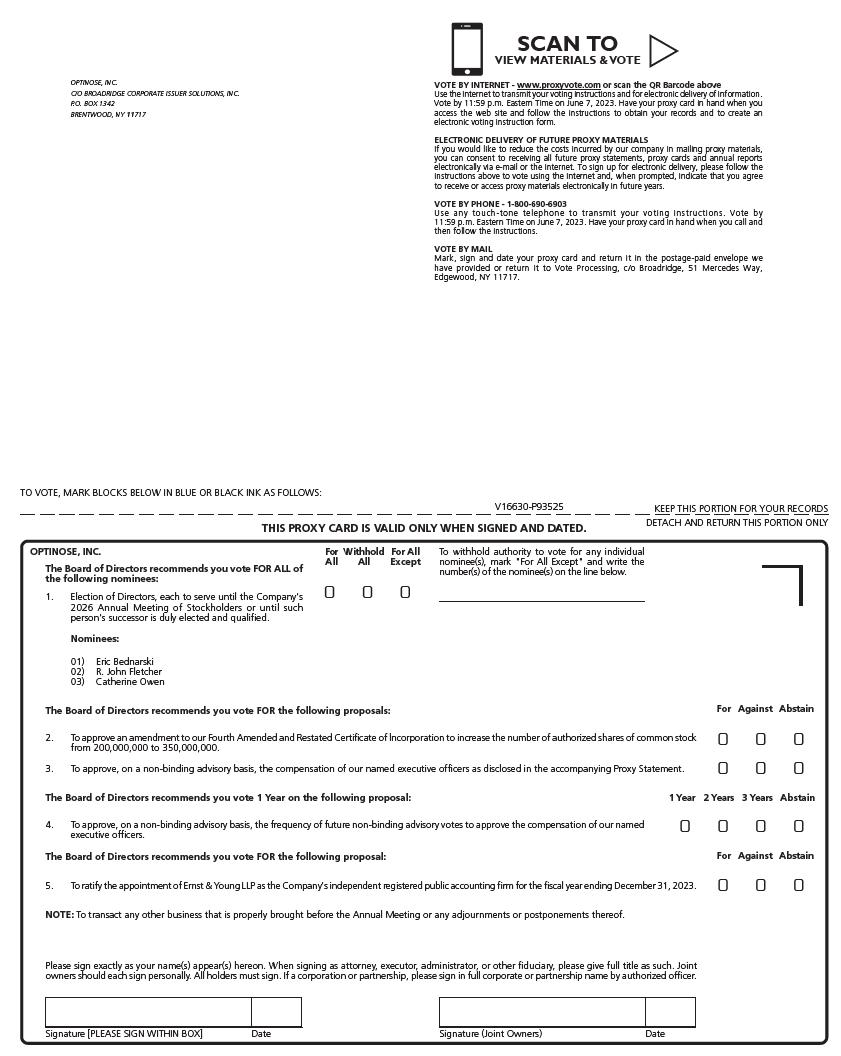

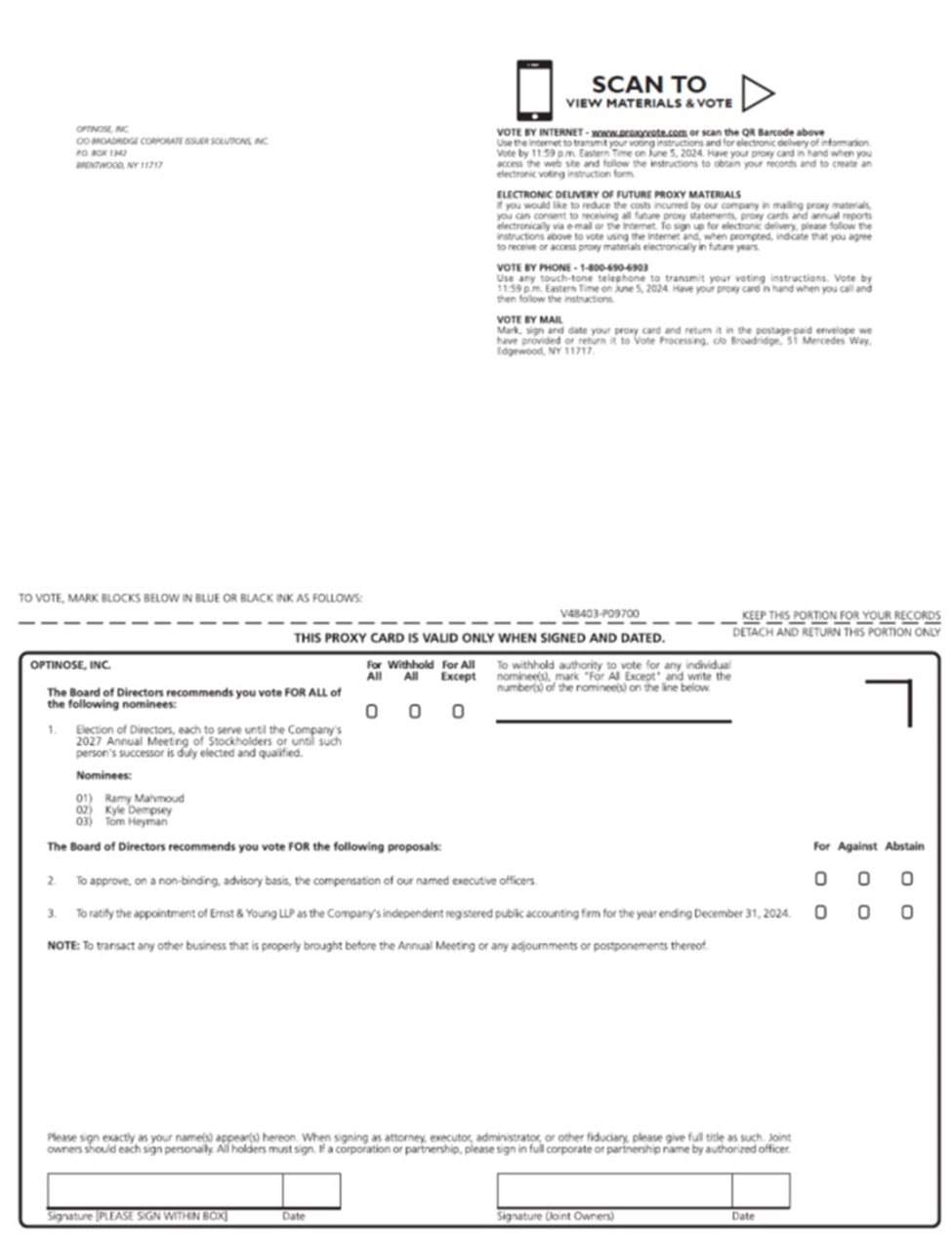

1.To elect Eric Bednarski, R. John FletcherRamy A. Mahmoud, Tomas J. Heyman and Catherine OwenKyle Dempsey to our Board of Directors, each to serve until our 20262027 Annual Meeting of Stockholders or until such person's successor is duly elected and qualified.

2.To approve an amendment to our Fourth Amended and Restated Certificate of Incorporation to increase the number of authorized shares of common stock from 200,000,000 to 350,000,000.

3.To approve, on a non-binding advisory basis, the compensation of our named executive officers as disclosed in the accompanying Proxy Statement.

4.To approve, on a non-binding advisory basis, the frequency of future non-binding advisory votes to approve the compensation of our named executive officers.

5.3.To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023.2024

6.4.To transact any other business that is properly brought before the Annual Meeting or any adjournments or postponements thereof.

Our Board of Directors has fixed the close of business on April 18, 20239, 2024 as the record date (Record Date) for determining the stockholders entitled to receive notice of, and to vote at, the Annual Meeting or any adjournments or postponements thereof. The Annual Meeting may be adjourned or postponed from time to time without notice other than by announcement at the Annual Meeting.

We are using the “Notice and Access” method of providing proxy materials to you via the Internet. We are mailing to you a Notice of Internet Availability of Proxy Materials instead of paper copies of this Notice of 2024 Annual Meeting of Stockholders and Proxy Statement (this Notice and Proxy Statement) and our Annual Report on Form 10-K for the year ended December 31, 2023 (Annual Report). Notice and Access provides a convenient way for you to access our proxy materials. The Notice of Internet Availability of Proxy Materials includes instructions on how to access this Notice and Proxy Statement and our Annual Report and how to vote your shares. The Notice of Internet Availability of Proxy Materials also contains instructions on how to receive a paper copy of the proxy materials and our Annual Report, if you prefer.

Your vote is important. Even if you plan to attend the Annual Meeting, we urge you to submit your proxy or voting instructions as soon as possible so that your shares may be voted at the Annual Meeting. For specific instructions on how to vote your shares, please refer to the "Questions and Answers About the Proxy Materials, Voting and the Annual Meeting" section of this Proxy Statement.

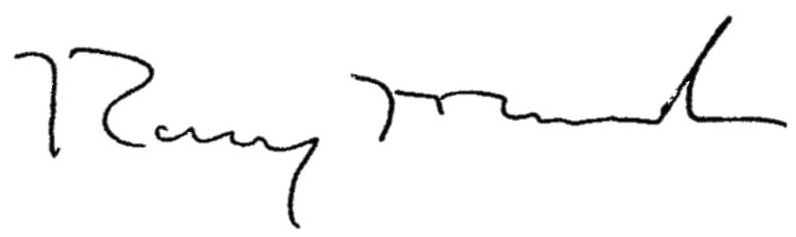

By Order of the Board of Directors,

| | | | | |

| Ramy A. Mahmoud, M.D., M.P.H. | |

| Chief Executive Officer and member of the Board of Directors | May 1, 2023April 26, 2024 |

Optinose - Notice of 20232024 Annual Meeting of Stockholders

20232024 PROXY STATEMENT SUMMARYSet forth below are highlights of important information you will find in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

ANNUAL MEETING OF STOCKHOLDERS | | | | | | | | | | | |

| Time and Date | Record Date | Place | Number of Common Shares Eligible to

Vote as of the Record Date |

8:30 a.m. (Eastern Time) on June 8, 20236, 2024 | April 18, 20239, 2024 | 1020 Stony Hill777 Township Line Road, Suite 300, Yardley, PA 19067 | 111,955,893113,038,726 |

VOTING MATTERS | | | | | | | | |

| | Board Recommendation |

| Proposal No. 1: | To elect Eric Bednarski, R. John FletcherRamy A. Mahmoud, Tomas J. Heyman and Catherine OwenKyle Dempsey to our Board of Directors, each to serve until our 20262027 Annual Meeting of Stockholders or until such person's successor is duly elected and qualified. | FOR ALL |

| Proposal No. 2: | To approve an amendment to our Fourth Amended and Restated Certificate of Incorporation to increase the number of authorized shares of common stock from 200,000,000 to 350,000,000. | FOR |

Proposal No. 3: | To approve, on a non-binding advisory basis, the compensation of our named executive officers as disclosed in the accompanying Proxy Statement. | FOR |

Proposal No. 4: | To approve, on a non-binding advisory basis, the frequency of future non-binding advisory votes to approve the compensation of our named executive officers. | 1 YEAR |

Proposal No. 5:3: | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 20232024 | FOR |

OUR DIRECTOR NOMINEES

You are being asked to elect Eric Bednarski, R. John FletcherRamy A. Mahmoud, Tomas J. Heyman and Catherine Owen,Kyle Dempsey, each of whom currently serves on our Board of Directors. Our directors are divided into three classes, Class I directors, Class II directors and Class III directors, serving staggered three-year terms. Directors are elected by a plurality of votes cast. Detailed information about the background and areas of expertise of each director and director nominee can be found in the "Executive Officers and Directors - Directors" section of this Proxy Statement. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Committee Membership |

| Name | | Age | | Director Since | | Principal Occupation | | AC | CC | NCG |

| | | | | | | | | | |

| Eric Bednarski | | 51 | | 2021 | | Partner - MVM Partners LLP | | | | «

|

| R. John Fletcher | | 77 | | 2022 | | CEO & Managing Partner - Fletcher Spaght Ventures | | «

| | |

| Catherine Owen | | 52 | | 2020 | | SVP, Major Markets - Bristol-Myers Squibb | | | «

| |

| | | | | | | | | Chair | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Committee Membership |

| Name | | Age | | Director Since | | Principal Occupation | | AC | CC | NCG |

| | | | | | | | | | |

| Ramy A Mahmoud | | 59 | | 2023 | | CEO of OptiNose, Inc. | | | | |

| Tomas J. Heyman | | 68 | | 2020 | | Retired President Corporate Venture Capital Group of Johnson & Johnson | | | «

| «

|

| Kyle Dempsey | | 35 | | 2021 | | Partner - MVM Partners LLP | | | «

| |

AC = Audit Committee; CC = Compensation Committee; NCG = Nominating and Corporate Governance Committee

As previously announced on a Form 8-K that we filed on March 28, 2023, Joseph Scodari will be retiring from the Board of Directors immediately following the 2023 Annual Meeting. Mr. Scodari currently serves as Chairman of the Board, a member of the Compensation Committee and Chairman of the Nominating and Corporate Governance Committee. Effective upon Mr. Scodari's retirement and subject to Mr. Fletcher's re-election at the 2023 Annual Meeting, Mr. Fletcher will serve as Chairman of the Board and fill the vacancies that will be created by Mr. Scodari's retirement as a member of the Compensation

Optinose - 20232024 Proxy Statement | 1

Committee and Chairman of the Nominating and Corporate Governance Committee. Mr. Fletcher will also continue to serve as a member of the Audit Committee.

CORPORATE GOVERNANCE SUMMARY FACTS

The following table summarizes our current Board structure and key elements of our corporate governance framework: | | | | | | | | |

| Size of Board (set by the Board) | | 9 *8 |

| Number of Independent Directors | | 8 *7 |

| Independent Chairman of the Board | | Yes |

| Review of Independence of Board | | Annual |

| Independent Directors Meet Without Management Present | | Yes |

| Voting Standard for Election of Directors in Uncontested Elections | | Plurality |

| Term of Directors | | Staggered / 3yr |

| Poison Pill | | No |

| Diversity of Board Background, Experience and Skills | | Yes |

| Frequency of "Say-on-Pay" Vote | | Annual |

* As noted above, Mr. Scodari will be retiring from the Board of Directors immediately following the 2023 Annual Meeting. As a result, immediately following the 2023 Annual Meeting, the size of the Board will be reduced from nine (9) to eight (8) members, of which seven (7) members will be independent directors.

Optinose - 20232024 Proxy Statement | 2

QUESTIONS AND ANSWERS

ABOUT

THE PROXY MATERIALS, VOTING AND THE ANNUAL MEETING

Why amdid I receiving thesereceive a “Notice of Internet Availability of Proxy Materials” but no proxy materials?

We are distributing our proxy materials to stockholders via the Internet under the “Notice and Access” approach permitted by rules of the U.S. Securities and Exchange Commission (SEC). This approach provides a timely and convenient method of accessing the materials and voting. On or about April 26, 2024, we will begin mailing a “Notice of Internet Availability of Proxy Materials” to stockholders, which will include instructions on how to access our Notice of 2024 Annual Meeting of Stockholders, this Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2023 and how to vote your shares. The Notice of Internet Availability of Proxy Materials also contains instructions on how to receive a paper copy of the proxy materials and our Annual Report, if you prefer.

What is the purpose of the proxy materials?

Our Board of Directors is soliciting your proxy to vote at our 20232024 Annual Meeting of Stockholders (Annual Meeting), which will take place on Thursday, June 8, 20236, 2024 at 8:30 a.m., Eastern Time, at the offices of OptiNose, Inc., 1020 Stony Hill777 Township Line Road, Suite 300, Yardley, PA 19067. On or about May 1, 2023, we will begin mailing the proxy materials to our stockholders whoYou received a Notice of Internet Availability of Proxy Materials because you owned shares of Optinose common stock at the close of business on April 18, 20239, 2024 (Record Date), and that entitles you to vote at the Annual Meeting. The proxy materials describe the matters on which our Board of Directors would like you to vote and contain information that we are required to provide to you under the rules of the U.S. Securities and Exchange Commission (SEC)SEC when we solicit your proxy. As many of our stockholders may be unable to attend the Annual Meeting, proxies are solicited to give each stockholder an opportunity to vote on all matters that will properly come before the Annual Meeting. References in this Proxy Statement to the Annual Meeting include any adjournments or postponements of the Annual Meeting.

What is included in the proxy materials?

The proxy materials include:

•the Notice of 20232024 Annual Meeting of Stockholders and this Proxy Statement (Proxy Statement);

•our 20222023 Annual Report to Stockholders, which consists of our Annual Report on Form 10-K for the year ended December 31, 20222023 (Annual Report); and

•a proxy or voting instruction card that accompanies these materials.

What information is contained in this Proxy Statement and our Annual Report?

The information in this Proxy Statement relates to the proposals to be voted on at the Annual Meeting, the voting process, beneficial owners of our common stock, corporate governance matters, the compensation of our directors and certain of our executive officers and other required information. Our Annual Report contains information about our business, our audited financial statements and other important information that we are required to disclose under the rules of the SEC.

How can I access the proxy materials over the Internet?

The proxy or voting instruction card that accompanied these materials,Notice of Internet Availability of Proxy Materials contains instructions on how to:

•view the proxy materials for the Annual Meeting on the Internet and vote your shares; and

•instruct us to send our future proxy materials to you electronically by email.

Our proxy materials are also available at www.proxyvote.com.

Choosing to receive your future proxy materials or “Notice and Access” notification by email will save us the cost of printing and mailing documents to you. If you choose to receive future proxy materials by email, you will receive an email next year

Optinose - 2024 Proxy Statement | 3

with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you revoke it.

What items of business will be voted on at the Annual Meeting and how does the Board recommend that I vote on each item?

Optinose - 2023 Proxy Statement | 3

The items of business scheduled to be voted on at the Annual Meeting and the Board's recommendation for voting on each item is set forth below:

| | | | | | | | |

| | | Board Recommendation |

| Proposal No. 1: | To elect Eric Bednarski, R. John FletcherRamy A. Mahmoud, Tomas J. Heyman and Catherine OwenKyle Dempsey to our Board of Directors, each to serve until our 20262027 Annual Meeting of Stockholders or until such person's successor is duly elected and qualified. | FOR ALL |

| | | |

| Proposal No. 2: | To approve an amendment to our Fourth Amended and Restated Certificate of Incorporation to increase the number of authorized shares of common stock from 200,000,000 to 350,000,000. | FOR |

| | |

Proposal No. 3: | To approve, on a non-binding advisory basis, the compensation of our named executive officers as disclosed in the accompanying Proxy Statement. | FOR |

| | |

Proposal No. 4: | To approve, on a non-binding advisory basis, the frequency of future non-binding advisory votes to approve the compensation of our named executive officers. | 1 YEAR |

| | |

Proposal No. 5:3: | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 20232024 | FOR |

| | |

| | |

| | |

| | |

See the "Proposals" section of this Proxy Statement for information on these proposals.

What happens if additional matters are presented at the Annual Meeting?

Other than the fivethree items of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy, the persons named as proxy holders, Dr. Ramy Mahmoud and Anthony Krick,Robert Duffield, or either of them, will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting or any adjournments or postponements thereof. If, for any reason, any of the director nominees is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by our Board of Directors.

How many votes do I have?

There were 111,955,893113,038,726 shares of common stock issued and outstanding as of the close of business on the Record Date. Each share of our common stock that you owned as of the Record Date entitles you to one vote on each matter presented at the Annual Meeting. Cumulative voting for directors is not permitted.

What is the difference between holding shares as a "stockholder of record" as compared to as a "beneficial owner"?

Most of our stockholders hold their shares as a beneficial owner through a broker, bank, trust or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

•Stockholder of Record: If your shares are registered directly in your name with our transfer agent, Broadridge Corporate Issuer Solutions, Inc., you are considered the stockholder of record with respect to those shares. As the stockholder of record, you have the right to grant your voting proxy directly to us or to vote in person at the Annual Meeting. If you do not wish to vote in person or you will not be attending the Annual Meeting, you may vote by proxy over the Internet, by telephone or by mail (if you properly request a paper copy of these proxy materials) by following the instructions contained in the Notice of Internet Availability of Proxy Materials or on the proxy card that accompanied your proxy materials. See “How can I vote my shares without attending the Annual Meeting?” below.

•Beneficial Owner: If your shares are held through a broker, bank, trust or other nominee, like the vast majority of our stockholders, you are considered the beneficial owner of shares held in street name, and certain proxy materials were forwarded to you by that organization. As the beneficial owner, you have the right to direct your broker, bank, trustee, or other nominee how to vote your shares. Since a beneficial owner is not the stockholder of record, you may not vote your

Optinose - 2024 Proxy Statement | 4

shares in person at the Annual Meeting unless you obtain a “legal proxy” from the broker, bank, trustee, or other nominee that holds your shares giving you the right to vote the shares at the Annual Meeting. If you do not wish to vote in person or you will not be attending the Annual Meeting, you may vote by proxy over the Internet, by telephone or by mail (if you properly request a paper copy of these proxy materials) by following the instructions in the Notice of Internet Availability of Proxy Materials or on the voting instruction card provided to you by your broker, bank, trustee, or other nominee. See “How can I vote my shares without attending the Annual Meeting?” below.

Optinose - 2023 Proxy Statement | 4

How can I vote my shares in person at the Annual Meeting?

If you hold your shares in your name as the stockholder of record, you may vote in person at the Annual Meeting. If you are the beneficial owner of shares held in street name, you may vote your shares in person at the Annual Meeting only if you obtain a legal proxy from the broker, bank, trustee, or other nominee that holds your shares giving you the right to vote the shares. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions as described below so that your vote will be counted if you later decide not to attend the Annual Meeting.

How can I vote my shares without attending the Annual Meeting?

Whether you hold shares directly as the stockholder of record or as the beneficial owner of shares held in street name, you may direct how your shares are voted without attending the Annual Meeting.

•Stockholder of Record: If you are a stockholder of record, you may vote by proxy. You can vote by proxy over the Internet, by telephone or by mail (if you properly request a paper copy of these proxy materials) by following the instructions in the Notice of Internet Availability of Proxy Materials or on the proxy card that accompanied your proxy materials.

•Beneficial Owner: If you are the beneficial owner of shares held in street name, you may also vote by proxy over the Internet, by telephone or by mail (if you properly request a paper copy of these proxy materials) by following the instructions in the Notice of Internet Availability of Proxy Materials or on the voting instruction card provided to you by your broker, bank, trustee, or other nominee.

Can I change my vote or revoke my proxy?

If you are the stockholder of record, you may change your vote at any time prior to the taking of the vote at the Annual Meeting by:

•granting a new proxy bearing a later date by following the instructions provided in the Notice of Internet Availability of Proxy Materials or proxy card that accompanied your proxy materials;

•providing a written notice of revocation to our Corporate Secretary at 1020 Stony Hill Road, Suite 300, Yardley, Pennsylvania 19067, which notice must be received by our Corporate Secretary before the Annual Meeting; or

•attending the Annual Meeting and voting in person.

If you are the beneficial owner of shares held in street name, you may change your vote at any time prior to the taking of the vote at the Annual Meeting by:

•submitting new voting instructions to your broker, bank, other trustee, or nominee by following the instructions provided in the voting instruction card provided to you by your broker, bank, trustee, or other nominee; or

•if you have obtained a valid legal proxy from your broker, bank, trustee, or other nominee giving you the right to vote your shares, by attending the Annual Meeting and voting in person using the valid legal proxy.

Note that for both stockholders of record and beneficial owners, attendance at the Annual Meeting will not cause your previously granted proxy or voting instructions to be revoked unless you specifically so request or vote in person at the Annual Meeting.

Optinose - 2024 Proxy Statement | 5

Is my vote confidential?

Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed to third parties, except: (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, and (3) to facilitate a successful proxy solicitation.

What is a "broker non-vote"?

If you are a beneficial owner of shares held by a broker, bank, trust or other nominee and you do not provide your broker, bank trust or other nominee with voting instructions, your shares may constitute “broker non-votes”. Broker non-votes occur on a matter when the broker, bank, trust or other nominee is not permitted under applicable stock exchange rules to vote on that

Optinose - 2023 Proxy Statement | 5

matter without instructions from the beneficial owner and instructions are not given. These matters are referred to as “non-routine” matters.

Proposal No. 1 Proposal No. 3 and Proposal No. 42 are considered "non-routine" matters, while Proposal No. 2 and Proposal No. 5 are3 is considered a "routine" matters.matter. Therefore, if you are a beneficial owner of shares held in street name and do not provide voting instructions, your shares will not be voted on Proposal No. 1 or Proposal No. 3 and Proposal No. 42 and a broker non-vote will occur on these matters. Because Proposal No. 2 and Proposal No. 5 are3 is considered a "routine" matters,matter, a broker, bank, trustee or other nominee will be permitted to exercise its discretion on these proposals,this proposal, which means there will be no broker non-votes on these matters.Proposal No. 3.

How many shares must be present or represented to conduct business at the Annual Meeting?

A "quorum" is necessary to conduct business at the Annual Meeting. A quorum is established if the holders of a majority of all shares issued and outstanding and entitled to vote at the Annual Meeting are present at the Annual Meeting, either in person or represented by proxy. Abstentions and broker non-votes will be counted as present for purposes of determining a quorum at the Annual Meeting. If a quorum is not present, the Annual Meeting will be adjourned until a quorum is obtained.

What are the voting requirements to approve the proposals discussed in this Proxy Statement?

•Proposal No. 1: Election of Directors. Votes may be cast: FOR ALL nominees, WITHHOLD ALL nominees or FOR ALL EXCEPT those nominees noted by you on the appropriate portion of your proxy or voting instructions. A plurality of the votes cast by the holders of record of common stock entitled to vote in the election of directors is required to elect director nominees, and as such, the three nominees who receive the greatest number of votes cast by stockholders entitled to vote on the matter will be elected. Broker non-votes and abstentions will have no effect on the outcome of this proposal.

•Proposal No. 2: Increase in the Number of Authorized Shares of Common Stock. Votes may be cast: FOR, AGAINST or ABSTAIN. The approval of this proposal requires the affirmative vote of the holders of at least a majority of the voting power of the Company's then outstanding shares of stock entitled to vote on this proposal, voting together as a single class. Broker non-votes will not occur in connection with this proposal because brokers, banks, trustees and other nominees have discretionary voting authority to vote shares on this proposal under stock exchange rules without specific instructions from the beneficial owner of such shares. Abstentions with respect to this proposal will have the effect of votes AGAINST this proposal.

•Proposal No. 3: Advisory Vote on Executive Compensation. Votes may be cast: FOR, AGAINST or ABSTAIN. The approval of this proposal requires the affirmative vote of the holders of shares having a majority of the votes cast by the holders of all of the shares of stock present or represented by proxy at the Annual Meeting and voting on the proposal.proposal (meaning the number of shares voted FOR the proposal must exceed the number of shares voted AGAINST the proposal). Broker non-votes and abstentions with respect to this proposal will have no effect on the outcome of this proposal.

•Proposal No. 4: Advisory Vote on the Frequency of Future Advisory Votes on Executive Compensation. Votes may be cast: 1 YEAR, 2 YEARS, 3 YEARS or ABSTAIN. The approval of the selected frequency requires the affirmative vote of the holders of shares having a majority of the votes cast by the holders of all of the shares of stock present or represented by proxy at the Annual Meeting and voting on the proposal. However, because stockholders have several voting choices with respect to this proposal, it is possible that no single choice will receive a majority vote. In light of the foregoing, the Board will consider the outcome of the vote when determining the frequency of future non-binding advisory votes on executive compensation. Broker non-votes and abstentions will have no effect on the outcome of this proposal. Moreover, because this vote is non-binding, the Board may determine the frequency of future advisory votes on executive compensation in its discretion.

•Proposal No. 5:3: Ratification of the Appointment of Independent Registered Public Accounting Firm. Votes may be cast: FOR, AGAINST or ABSTAIN. The approval of this proposal requires the affirmative vote of the holders of shares having a majority of the votes cast by the holders of all of the shares of stock present or represented by proxy at the Annual Meeting and voting on the proposal (meaning the number of shares voted FOR the proposal must exceed the number of shares voted AGAINST the proposal). Broker non-votes will not occur in connection with this proposal because brokers, banks, trustees and other nominees have discretionary voting authority to vote shares on the ratification of independent registered public accounting firms under stock exchange rules without specific instructions from the beneficial owner of such shares. Abstentions will have no effect on the outcome of this proposal.

Optinose - 2023 Proxy Statement | 6

Who will bear the cost of soliciting votes for the Annual Meeting, and how will proxies be solicited?

We will pay the entire cost of preparing, assembling, printing, mailing and distributing the Notice of Internet Availability of Proxy Materials and these proxy materials, as well as for soliciting votes. Our directors, officers and employees may solicit proxies or votes in person, by telephone or by electronic communication. We will not pay our directors, officers or employees any additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to

Optinose - 2024 Proxy Statement | 6

forward the applicable proxy materials to their principals and to obtain authority to execute proxies and will reimburse them for certain costs in connection with such activities.

Who will count the votes?

Votes will be counted by the inspector of election appointed for the Annual Meeting.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting and disclose the final voting results in a Current Report on Form 8-K that we will file with the SEC within four business days of the Annual Meeting.

Attending the Annual Meeting

How can I attend the Annual Meeting?

You are entitled to attend the Annual Meeting only if you were an Optinose stockholder as of the Record Date (April 18, 2023)9, 2024), or you hold a valid legal proxy from a stockholder of record for attending or voting at the Annual Meeting. You must present valid government-issued photo identification, such as a driver’s license or passport, for admittance. If you are not a stockholder of record but hold shares as a beneficial owner in street name, you must also provide proof of beneficial ownership as of the Record Date, such as your most recent account statement prior to April 18, 2023,9, 2024, or a copy of the voting instruction card provided by your broker, bank, trustee, or other nominee, or other similar evidence of ownership. If you do not provide photo identification or comply with the other procedures outlined above, you will not be admitted to the Annual Meeting.

Please let us know if you plan to attend the Annual Meeting by indicating your plans when prompted if you vote by Internet or telephone or, if you vote by mail, by marking the appropriate box on your proxy or voting instruction card.

The Annual Meeting will begin promptly at 8:30 a.m., Eastern Time. Check-in will begin at 8:00 a.m., Eastern Time, and you should allow ample time for the check-in procedures. The Annual Meeting will be held at the offices of OptiNose, Inc. are located at 1020 Stony Hill777 Township Line Road, Suite 300, Yardley, PA 19067.

PROPOSALS

Proposal 1: Election of Directors

General

Our Fourth Amended and Restated Certificate of Incorporation, as amended (Certificate of Incorporation), provides that our directors be divided into three classes, Class I directors, Class II directors and Class III directors, serving staggered three-year terms. Currently, our Board is composed of nine (9) directors with three (3) directors serving in each class.eight (8) directors. The terms of our three (3) Class IIII directors will expire at the Annual Meeting and our stockholders are being asked at the Annual Meeting to re-elect Messrs. BednarskiMahmoud, Tomas and Fletcher and Ms. OwenDempsey as Class IIII directors, as discussed in more detail below. In addition, as previously mentioned, Mr. Scodari will be retiring from our Board immediately following the Annual Meeting. As a result, the size of the Board of Directors will be reduced from nine (9) members to eight (8) members and the number of Class II directors will be reduced from three (3) to two (2).

Our Board of Directors has nominated, upon the recommendation of our Nominating and Corporate Governance Committee, Eric Bednarski, R. John FletcherRamy A. Mahmoud, Tomas J. Heyman and Catherine OwenKyle Dempsey for re-election as Class IIII directors at the Annual Meeting, each to serve a three-year term expiring at our 20262027 Annual Meeting of Stockholders or until such person's successor is duly elected and qualified, or until his or hersuch person's earlier death, resignation, removal or retirement. Messrs. Mahmoud, Tomas and Dempsey are currently serving as Class I directors. We expect each nominee will be able to serve if

Optinose - 2023 Proxy Statement | 7

elected. If any nominee is unable to serve, proxies will be voted in favor of the remainder of those nominees and for such substitute nominee as may be selected by our Board of Directors.

Optinose - 2024 Proxy Statement | 7

Biographical information and the attributes, skills and experience of each nominee that led our Nominating and Corporate Governance Committee and Board of Directors to determine that each such nominee should serve as a director are discussed in the "Executive Officers and Directors" section of this Proxy Statement.

Vote Required and Recommendation of our Board

The three director nominees receiving the highest number of FOR votes will be elected to our Board of Directors, each to serve until our 20262027 Annual Meeting of Stockholders or until such person's successor is duly elected and qualified, or until his or hersuch person's earlier death, resignation, removal or retirement. Broker non-votes and abstentions will have no effect on the outcome of this proposal.

Our Board of Directors recommends that stockholders vote FOR ALL on Proposal No. 1 to elect Eric Bednarski, R. John FletcherRamy A. Mahmoud, Tomas J. Heyman and Catherine Owen.Kyle Dempsey.

Proposal 2: Increase in the Number of Authorized Shares of Common Stock

General

Our Board has approved, and recommends that our stockholders approve, an amendment to our Certificate of Incorporation, in substantially the form attached hereto as Annex A (the “Authorized Shares Amendment”), to increase the number of authorized shares of our common stock from 200,000,000 to 350,000,000. If the stockholders approve the Authorized Shares Amendment, the authorized share increase will become effective upon the filing of the Authorized Shares Amendment with the Secretary of State of the State of Delaware. This proposal is referred to below as the “Authorized Shares Proposal.”

Capitalization

As of April 14, 2023, we were authorized to issue up to 200,000,000 shares of our common stock, par value $0.001 per share, 111,955,893 of which were issued and outstanding, 9,874,520 of which were reserved for issuance upon exercise of outstanding stock options granted under our 2010 Stock Incentive Plan, as amended and restated (the "2010 Stock Incentive Plan") having a weighted average exercise price of $5.25, 2,684,993 of which were reserved for issuance upon the vesting of outstanding restricted stock units under the 2010 Stock Incentive Plan, 5,418,504 of which were reserved for future grants under the 2010 Stock Incentive Plan, 1,540,453 of which were reserved for issuance under our 2017 Employee Stock Purchase Plan, 653,751 of which were reserved for issuance upon exercise of outstanding stock options granted outside of the 2010 Stock Incentive Plan having a weighted average exercise price of $1.76, and 32,768,000 of which were reserved for issuance upon exercise of outstanding warrants. Accordingly, as of April 14, 2023, there were 35,103,886 shares of our common stock available for all other corporate purposes, such as additional capital raising activities, prior to the addition of the shares for which we are seeking approval pursuant to this proposal.

In addition to our authorized shares of common stock, we are authorized to issue up to 5,000,000 shares of preferred stock, par value $0.001 per share, in one or more series designated by the Board, none of which are outstanding.

Reasons for Increase in Authorized Shares of Common Stock

The Board believes the proposed increase in the number of authorized shares of common stock from 200,000,000 to 350,000,000 is in the best interests of our Company and our stockholders because the availability of additional authorized but unissued shares of common stock will provide us with greater flexibility in considering future actions that may be desirable or necessary to accomplish our business objectives and that involve the issuance of our common stock. An increase in the number of authorized shares would allow us to issue common stock for a variety of corporate purposes, such as raising additional capital, without the delay associated with soliciting stockholder approval and convening a special meeting of stockholders. Capital that we raise through the issuance of additional shares could be used to continue or expand our commercialization efforts for XHANCE, or to expand or diversify our business or research and development programs through the acquisition of other businesses or products. Currently, there are no immediate plans, agreements or commitments with respect to the issuance of any of the additional shares of common stock.

Optinose - 2023 Proxy Statement | 8

Effects on Existing Stockholders of the Proposal

If the Authorized Shares Proposal is approved, the Board may cause the issuance of the additional shares of common stock resulting from the Authorized Shares Amendment without further approval, except as may be required by law, regulatory authorities, or the rules of The Nasdaq Stock Market (“Nasdaq”) or any other stock exchange on which our shares may be listed. The proposed new authorized shares of common stock would become part of the existing class of our common stock and, if and when issued, would have the same rights and privileges as the shares of common stock presently issued and outstanding. Holders of shares of our common stock (in their capacity as holders of shares of our common stock) do not have any preemptive rights to purchase or subscribe for any part of any new or additional issuance of our securities. The existing stockholders will not suffer any immediate dilution in voting rights and in ownership interests upon the authorization of additional shares of common stock. However, if we issue additional shares of our common stock in future actions that we may deem desirable or necessary to accomplish our business objectives, our existing stockholders could suffer dilutive consequences. Any sale of our common stock into the public market could materially and adversely affect the market price of our common stock. An increase in the number of authorized shares of our common stock may make it more difficult to, or discourage an attempt to, obtain control of us by means of a takeover bid that the Board determines is not in our best interest nor in the best interests of our stockholders. However, the Board does not intend or view the proposed increase in the number of authorized shares of common stock as an anti-takeover measure and is not aware of any attempt or plan to obtain control of us. We have no current plans or proposals to adopt other provisions or enter into other arrangements that may have material anti-takeover consequences.

Interests of Officers and Directors in this Proposal

Our officers and directors do not have any substantial interest, direct or indirect, in in this proposal.

No Appraisal Rights

The Company’s stockholders are not entitled to appraisal rights under Delaware law or the Company’s Certificate of Incorporation with respect to the Authorized Shares Amendment, and the Company will not independently provide our stockholders with any such right.

Vote Required and Recommendation of Our Board

Approval of the Authorized Shares Proposal requires the affirmative vote of the holders of at least a majority of the voting power of the Company's then outstanding shares of stock entitled to vote on the proposal, voting together as a single class. There will be no broker non-votes with respect to this proposal. Abstentions will have the effect of a vote AGAINST this proposal.

Our Board recommends that stockholders vote FOR the Authorized Shares Proposal.

Proposal 3: Advisory Vote on Executive Compensation

Pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 and Section 14A of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), we are conducting a stockholder advisory vote on the compensation paid to our named executive officers. This proposal, commonly known as “say-on-pay,” gives our stockholders the opportunity to express their views on our named executive officers’ compensation as disclosed in this Proxy Statement. The vote is advisory, and, therefore, it is not binding on our Board, our Compensation Committee, or the Company. Nevertheless, our Board and Compensation Committee will take into account the outcome of the vote when considering future executive compensation decisions. We currently intendSection 14A of the Exchange Act also requires that stockholders have the opportunity, at least once every six years, to conduct thiscast an advisory vote with respect to whether future executive compensation advisory votes will be held every one, two, or three years. At our 2023 Annual Meeting of Stockholders, our stockholders indicated their preference for an advisory vote on the compensation of our named executive officers to be held annually, subject towhich annual frequency was also the outcomerecommendation of our Board. Our Board subsequently determined that we will hold an advisory vote on the advisorycompensation of our named executive officers on an annual basis until the next required vote on the frequency of futuresuch advisory votes, on named executive officer compensation, as discussedor until our Board otherwise determines that a different frequency for such votes is in Proposal No. 4.the best interests of our stockholders.

Our executive compensation program is designed to attract, motivate and retain our named executive officers who are critical to our success. Our Board believes that our executive compensation program is tailored to retain and motivate key executives while recognizing the need to align our executive compensation program with the interests of our stockholders. Our Compensation Committee, with the advice and assistance of its independent compensation consultant, Pearl Meyer & Partners, LLC, regularlycontinually reviews the compensation programs for our named executive officers to ensure they achieve the desired goals of aligning our executive compensation structure with our stockholders’ interests and current market practices.

Optinose - 2023 Proxy Statement | 9

We encourage our stockholders to read the “Summary Compensation Table” and other related compensation tables and narrative disclosures in the “Executive Compensation” section of this Proxy Statement, which describe the 20222023 compensation of our named executive officers.

We are asking our stockholders to approve, on an advisory basis, the compensation of our named executive officers as disclosed in this Proxy Statement pursuant to Item 402 of Regulation S-K, including the compensation tables and the narrative disclosures that accompany the compensation tables.

Vote Required and Recommendation of Our Board

Approval of this proposal requires the affirmative vote of the holders of shares having a majority of the votes cast by the holders of all the shares of stock present or represented by proxy at the Annual Meeting and voting on the proposal.proposal (meaning the number of shares voted FOR the proposal must exceed the number of shares voted AGAINST the proposal). Broker non-votes and abstentions with respect to this proposal will have no effect on the outcome of this proposal.

Our Board recommends that stockholders vote FOR to approve, on an advisory basis, the compensation of our named executive officers as disclosed in this Proxy Statement.

Proposal 4: Advisory Vote on the Frequency of Future Advisory Votes on Executive Compensation

General

In Proposal No. 3, we are providing our stockholders the opportunity to vote to approve, on an advisory non-binding basis, the compensation of our named executive officers as disclosed in this Proxy Statement. In this Proposal No. 4, we are asking our stockholders to cast a non-binding advisory vote regarding the frequency of future executive compensation advisory votes. Stockholders may vote for a frequency of every one, two, or three years, or may abstain.

Our Board will take into consideration the outcome of this vote in making a determination about the frequency of future executive compensation advisory votes. However, because this vote is advisory and non-binding, our Board may decide that it is in the best interests of our stockholders and the Company to hold the advisory vote to approve executive compensation more or less frequently. At least once every six calendar years we are required to provide stockholders with the opportunity to cast a non-binding advisory vote on the frequency of future advisory votes on executive compensation as provided for in this Proposal No. 4.

Our Board recommends that you vote for a frequency of 1 YEAR for future executive compensation advisory votes. Our Board believes that an annual executive compensation advisory vote will facilitate more direct stockholder input about executive compensation. An annual executive compensation advisory vote is consistent with our policy of reviewing our compensation programs annually.

Vote Required and Recommendation of Our Board

The approval of the selected frequency requires the affirmative vote of the holders of shares having a majority of the votes cast by the holders of all of the shares of stock present or represented by proxy at the Annual Meeting and voting on the proposal. However, because stockholders have several voting choices with respect to this proposal, it is possible that no single choice will receive a majority vote. In light of the foregoing, our Board will consider the outcome of the vote when determining the frequency of future non-binding advisory votes on executive compensation. Moreover, because this vote is non-binding, our Board may determine the frequency of future advisory votes on executive compensation in its discretion. Broker non-votes and abstentions with respect to this proposal will have no effect on the outcome of this proposal.

Our Board recommends that stockholders vote for 1 YEAR as the preferred frequency of future advisory votes on the compensation of our named executive officers.

Optinose - 20232024 Proxy Statement | 108

Proposal 5:3: Ratification of Appointment of Independent Registered Public Accounting Firm

Our Audit Committee has appointed Ernst & Young LLP (EY) as our independent registered public accounting firm to audit our consolidated financial statements for the year ending December 31, 2023.2024. Although stockholder ratification of the appointment of EY is not required by our Amended and Restated Bylaws (Bylaws) or otherwise, our Board of Directors believes that it is desirable to give our stockholders the opportunity to ratify this appointment as a matter of good corporate governance. If this proposal is not approved at the Annual Meeting, our Audit Committee will reconsider, but may or may not change, its appointment of EY as our independent registered public accounting firm for the fiscal year ending December 31, 2023.2024. Even if the selection is ratified, our Audit Committee may, at its discretion, direct the selection of a different independent registered public accounting firm during the year if the Audit Committee determines such a change is desirable. Representatives of EY are expected to be present at the Annual Meeting. Such representatives will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Vote Required and Recommendation of Our Board

The approval of this Proposal No. 53 requires the affirmative vote of the holders of shares having a majority of the votes cast by the holders of all of the shares of stock present or represented by proxy and voting on the proposal at the Annual Meeting (meaning the number of shares voted FOR the proposal must exceed the number of shares voted AGAINST the proposal). Broker non-votes will not occur in connection with this proposal. Abstentions will have no effect on the outcome of this proposal.

Our Board recommends that stockholders vote FOR to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023.2024.

Our Board of Directors does not intend to bring any other matters before the Annual Meeting, nor does it know of any matters which other persons intend to bring before the Annual Meeting. If, however, other matters not mentioned in this Proxy Statement properly come before the Annual Meeting, the persons named in the accompanying form of proxy will vote on such matters in accordance with the recommendation of our Board of Directors.

Optinose - 20232024 Proxy Statement | 119

EXECUTIVE OFFICERS AND DIRECTORS

The following table sets forth the names and ages of all of our executive officers and directors as of April 18, 2023.9, 2024. | | | | | | | | | | | | | | |

| Name | | Title | | Age |

| Executive Officers | | | | |

| Ramy A. Mahmoud, M.D., M.P.H. | | Chief Executive Officer and Director | | 5859 |

| Anthony J. Krick | | Vice President, Finance and Chief Accounting Officer | | 4243 |

| Michael F. Marino | | Chief Legal Officer and Corporate Secretary | | 4748 |

| Paul Spence | | Chief Commercial Officer | | 55 |

| | | | |

| Directors | | | | |

Joseph C. ScodariR. John Fletcher | | Chairman of our Board of Directors | | 7078 |

| Eric Bednarski | | Director | | 5152 |

| Kyle Dempsey | | Director | | 34 |

R. John Fletcher | | Director | | 7735 |

| Wilhelmus Groenhuysen | | Director | | 6566 |

| Sandra L. Helton | | Director | | 7374 |

| Tomas J. Heyman | | Director | | 6768 |

| Ramy A. Mahmoud, M.D., M.P.H. | | Chief Executive Officer and Director | | 5859 |

| Catherine Owen | | Director | | 5253 |

Biographical information regarding our executive officers as of April 18, 20239, 2024 is set forth below. Our executive officers are appointed by, and serve at the pleasure of, our Board of Directors.

Optinose - 20232024 Proxy Statement | 1210

| | | | | | | | |

| Ramy A. Mahmoud, M.D., M.P.H. | | Dr. Mahmoud has served as our Chief Executive Officer and as a member of our Board of Directors since January 2023. Prior to being appointed Chief Executive Officer, Dr. Mahmoud served as our President and Chief Operating Officer since 2010. Prior to joining us, Dr. Mahmoud spent 14 years at Johnson & Johnson, where he most recently served as Chief Medical Officer and a member of the Global Management Board of the Ethicon group of companies. During his tenure at Johnson & Johnson, he also held senior roles in the pharmaceutical sector. Dr. Mahmoud served for 10 years on active duty in the U.S. Army and an additional 10 years in the Army Reserves, achieving the rank of Lieutenant Colonel. During his military service, Dr. Mahmoud held various patient care, research, and academic positions, culminating in his position as the head of the Department of Epidemiology at the Walter Reed Army Institute of Research. He has published more than 80 peer-reviewed papers and textbook chapters, and has served as a scientific reviewer for a number of journals and textbooks. Dr. Mahmoud earned a Master of Healthcare Management and Policy degree from the Harvard School of Public Health and an M.D. from the University of Miami. He has earned board certification in both Public Health/Preventive Medicine and in Internal Medicine. |

| Chief Executive Officer since January 2023 | |

|

| | | |

Anthony J. Krick

| | Mr. Krick has served as our VP, Finance and Chief Accounting Officer since June 2022. Prior to being appointed Chief Accounting Officer, Mr. Krick servedHe joined Optinose in November 2021 as our VP, Controller since November 2021.Controller. Prior to joining Optinose, Mr. Krick served as the Corporate Controller of Verrica Pharmaceuticals Inc., a publicly-traded medical dermatology company, from February 2020 to November 2021. Prior to joining Verrica, Mr. Krick served as Executive Director, Financial Planning & Analysis at Strongbridge Biopharma, plc, a pubicly-traded commercial rare disease company, from May 2017 to Feburary 2020. Earlier in his career, Mr. Krick held a number of positions of increasing responsibility at GlaxoSmithKline, Endo Pharmaceuticals and Ernst & Young, LLP. Mr. Krick earned a Bachelor of Science in accounting from Albright College and is a Certified Public Accountant (voluntary inactive status). |

| Chief Accounting Officer since June 2022 | |

| | |

| Michael F. Marino | | Mr. Marino has served as our Chief Legal Officer and Corporate Secretary since January 2017 and as a member of the board of directors of OptiNose AS since June 2018.2017. Prior to joining Optinose, Mr. Marino served as Senior Vice President, General Counsel and Corporate Secretary of Fibrocell Science, Inc., a publicly-traded cell and gene therapy company, from 2015 to 2017, and as Senior Vice President, General Counsel and Corporate Secretary of NuPathe Inc., a publicly-traded specialty pharmaceutical company from 2010 until the sale of NuPathe to Teva Pharmaceutical Industries Ltd. in 2014. From 2001 to 2010, Mr. Marino was an attorney at the law firms of Morgan, Lewis & Bockius LLP and WilmerHale LLP where his practice focused on mergers and acquisitions, financing transactions, collaborations, corporate governance, securities and other general corporate matters. Mr. Marino earned a B.S. in Accountancy from Villanova University and a J.D. from Boston College Law School. |

| Chief Legal Officer and Corporate Secretary since January 2017 | |

| | | |

Paul Spence Chief Commercial Officer since December 2022 | | Mr. Spence has served as our Chief Commercial Officer since December 2022. Prior to joining Optinose, Mr. Spence was most recently the Senior Vice President and U.S. Pharma Chief Commercial Officer at Nestlé Health Sciences where he led the Aimmune Gastrointestinal and Food Allergy businesses from 2020 to 2022 and prior to that, VP U.S. Commercial at Nestlé Health Sciences from 2016 to 2019. Prior to joining Nestlé Health Sciences, he had commercial roles of increasing responsibility at Boehringer-Ingelheim Pharmaceuticals, Sanofi-Aventis, and Bristol-Myers Squibb. Mr. Spence earned a Bachelor of Science in Finance and Accounting from Penn State University and an MBA from Villanova University. |

| |

Optinose - 20232024 Proxy Statement | 1311

Biographical information as of April 18, 20239, 2024 and the attributes, skills and experience of each director that led our Nominating and Corporate Governance Committee and our Board of Directors to determine that such individual should serve as a director are discussed below. | | | | | | | | |

Joseph C. Scodari | | Mr. Scodari has served as Chairman of our Board of Directors since October 2017. Mr. Scodari was Worldwide Chairman, Pharmaceuticals Group, of Johnson & Johnson, and a member of Johnson & Johnson's Executive Committee from March 2005 until his retirement in March 2008. From 2003 to March 2005, Mr. Scodari was Company Group Chairman of Johnson & Johnson's Biopharmaceutical Business. Mr. Scodari joined Johnson & Johnson in 1999 as President and Chief Operating Officer of Centocor Inc., when Johnson & Johnson acquired that company. Mr. Scodari joined Centocor in 1996 as President, Pharmaceutical Division and was named President and COO in 1998. Mr. Scodari began his career in 1974 in sales for Winthrop Laboratories, Division of Sterling Drug. He progressed through various management positions, eventually leading the Diagnostic Imaging Division for Winthrop and later Strategic Marketing at the Corporate level for the Imaging business. Mr. Scodari joined Rorer Pharmaceuticals (shortly thereafter, Rhône-Poulenc Rorer) in 1989 as Vice President of Marketing and Business Development. He later served as Vice President and General Manager for the United States, and subsequently, North America, and finally as Senior Vice President and General Manager for the Americas. Mr. Scodari previously served as a director of Actelion Pharmaceuticals, Ltd., Endo Health Solutions, Inc. and Covance, Inc., and currently serves as a director of Acurx, Inc. (Nasdaq: ACXP), a clinical stage biopharmaceutical company developing a new class of antibiotics for infections caused by bacteria listed as priority pathogens by the World Health Organization, Centers for Disease Control and Prevention, and Food and Drug Administration. Mr. Scodari has served on various non-profit boards, including the University of the Health Sciences in Philadelphia, the Board of Overseers for the Robert Wood Johnson School of Medicine, and on the Board of Trustees for Gwynedd Mercy College, and on the Board of Directors for Volunteers in Medicine, Hilton Head, SC. He has also served on various industry association boards, including the NWDA Associate Member Board, the National Pharmaceutical Council, as Vice Chairman of the Biotechnology Industry Organization (BIO), and Chairman of PA BIO. Mr. Scodari received a B.A. from Youngstown State University. |

Director since October 2017

| |

| | |

| | Key Attributes, Skills and Experience: Our Nominating and Corporate Governance Committee and our Board of Directors believe that Mr. Scodari's experience as an executive of a major pharmaceutical company along with his research and development and marketing experience qualifies him to serve on our Board of Directors.

|

| | |

Eric Bednarski, Ph.D. | | Dr. Bednarski has served as a director of our company since December 2021. Dr. Bednarski has served as a partner at MVM Partners LLP (MVM), a healthcare growth equity firm, since 2008. Before joining MVM, Dr. Bednarski was a Partner at Advent Healthcare Ventures and a Principal at Advent International Corporation. Dr. Bednarski currently serves on the Board of Directors of MDxHealth SA (NASDAQ: MDXH) a commercial stage precision diagnostics company, Neurolens, Inc., a developer of prescription lenses, and Vero Biotech, Inc., a biotechnology company focused on cardiopulmonary conditions. Dr. Bednarski has a B.S. in Neural Science from Brown University and a Ph.D. in Biological Science from the University of California, Irvine. |

Director since December 2021 | |

| | |

| | Key Attributes, Skills and Experience: Our Nominating and Corporate Governance Committee and our Board of Directors believe that Dr. Bednarski's financial acumen and substantial industry experience qualifies him to serve on our Board of Directors.

|

| | |

Optinose - 2023 Proxy Statement | 14

| | | | | | | | |

Kyle Dempsey, M.D. | | Dr. Dempsey has served as a director of our company since December 2021. Dr. Dempsey has served as a partner at MVM Partners LLP (MVM), a healthcare growth equity firm, since 2017. Before joining MVM, Dr. Dempsey was a consultant at Bain & Company from 2016 to 2017, working mainly in the healthcare practice to support medical device and healthcare provider clients with commercialization and business development projects. Dr. Dempsey is a member of the board of directors and audit committee at GT Medical Technologies, Inc., a private company focused on the treatment of brain tumors, and HLS Therapeutics Inc. (OTC: HLTRF), a pharmaceutical company focusing on central nervous system and cardiovascular markets. He received his M.D. from Harvard Medical School and his M.B.A. from Harvard Business School. He also holds a B.A. in biochemistry from Bowdoin College. |

Director since December 2021 | |

| | |

| | Key Attributes, Skills and Experience: Our Nominating and Corporate Governance Committee and our Board of Directors believe that Dr. Dempsey's financial acumen and substantial industry experience qualifies him to serve on our Board of Directors.

|

| | |

| R. John Fletcher | | Mr. Fletcher has served as a director of our company since April 2022. In 1983, Mr. Fletcher founded Fletcher Spaght, Inc., a consulting firm that provides growth-focused strategy assistance to healthcare companies, and since its founding has served as its Chief Executive Officer. Since 2001, Mr. Fletcher has also served as the Managing Partner of Fletcher Spaght Ventures, a venture capital fund. Mr. Fletcher’s current and past board experience includes both public and private companies. Mr. Fletcher currently serves as the board chairman of Repro Med Systems, Inc. (d/b/a KORU Medical Systems)(NASDAQ: (NASDAQ: KRMD), a proprietary portable and innovative medical devices manufacturing company. Mr. Fletcher also serves as the board chairman of Clearpoint Neuro, Inc. (NASDAQ:CLPT), a global therapy-enabling platform company, and privately-held Metabolon, Inc. a health technology company. Mr. Fletcher previously served on the boards of Vyant Bio, Inc., a drug discovery and preclinical oncology and immune-ology company, Spectranetics Corporation, a medical device company, Autoimmune, Inc., a biotechnology technology company, Axcelis Technologies, Inc., a semiconductor chip company, Fischer Imaging Corp., an advanced imaging company, Panacos Pharmaceuticals Inc., a biotechnology company focused on therapeutic solutions for infectious disease, and NMT Medical Inc., an implant technology company, all of which are or were public companies, and on the boardboards of GlycoFi, Inc. and Quick Study Radiology Inc., both of which are or were private companies. In addition, Mr. Fletcher has served on the boards of many academic and non-profit institutions. Mr. Fletcher worked on the $2 billion acquisition of Spectranetics by Koninklijke Philips N.V. (Royal Philips) and the $400 million acquisition of GlycoFi by Merck & Co., Inc., and received the National Association of Corporate Directors (NACD) Director of the Year Award in 2018 specifically due to his work with the turnarounds of Spectranetics and Axcelis. He is Chairman Emeritus of the Corporate Collaboration Council at the Thayer School of Engineering/Tuck School of Business at Dartmouth College and serves on the Board of Advisors of Beth Israel Deaconess Medical Center and the Whitehead Institute at MIT. Mr. Fletcher is a graduate of Southern Illinois University (MBA), Central Michigan University (Master’s Degree in International Finance), and George Washington University (BBA in Marketing) and was an instructor in International Business and was a PhD candidate at the Wharton School of Business. He also served as a Captain and jet pilot instructor in the United States Air Force.

|

| Director since April 2022 | |

| | |

| | Key Attributes, Skills and Experience: Our Nominating and Corporate Governance Committee and our Board of Directors believe that Mr. Fletcher's wealth of experience in healthcare, his strategic insight and leadership qualify him to serve on our Board of Directors. |

| | |

| Eric Bednarski, Ph.D. | | Dr. Bednarski has served as a director of our company since December 2021. Dr. Bednarski has served as a partner at MVM Partners LLP (MVM), a healthcare growth equity firm, since 2008. Before joining MVM, Dr. Bednarski was a Partner at Advent Healthcare Ventures and a Principal at Advent International Corporation. Prior to Advent, he was a Director in the Corporate Finance Group of Silicon Valley Bank. Dr. Bednarski currently serves on the Board of Directors of MDxHealth SA (NASDAQ: MDXH) a commercial stage precision diagnostics company, Neurolens, Inc., a developer of prescription lenses, and Vero Biotech, Inc., a biotechnology company focused on cardiopulmonary conditions. Dr. Bednarski has a B.S. in Neural Science from Brown University and a Ph.D. in Biological Science from the University of California, Irvine. |

| Director since December 2021 | |

| | |

| | Key Attributes, Skills and Experience: Our Nominating and Corporate Governance Committee and our Board of Directors believe that Dr. Bednarski's financial acumen and substantial industry experience qualifies him to serve on our Board of Directors. |

| | |

Optinose - 20232024 Proxy Statement | 1512

| | | | | | | | |

| Kyle Dempsey, M.D. | | Dr. Dempsey has served as a director of our company since December 2021. Dr. Dempsey has served as a partner at MVM Partners LLP (MVM), a healthcare growth equity firm, since 2018. Before joining MVM, Dr. Dempsey was a consultant at Bain & Company from 2016 to 2017, working mainly in the healthcare practice to support medical device and healthcare provider clients with commercialization and business development projects. Dr. Dempsey is a member of the board of directors and audit committee of HLS Therapeutics Inc. (TSX: HLS), a pharmaceutical company focusing on central nervous system and cardiovascular markets. He received his M.D. from Harvard Medical School and his M.B.A. from Harvard Business School. He also holds a B.A. in biochemistry from Bowdoin College. |

| Director since December 2021 | |

| | |

| | Key Attributes, Skills and Experience: Our Nominating and Corporate Governance Committee and our Board of Directors believe that Dr. Dempsey's financial acumen and substantial industry experience qualifies him to serve on our Board of Directors. |

| | |

| Wilhelmus Groenhuysen | | Mr. Groenhuysen has served as a director of our company since October 2017. Mr. Groenhuysen served as Chief Financial Officer of NovoCure Limited (NovoCure) from 2012 until August 31, 2020, and has served as NovoCure's Chief Operating Officer since September 1, 2020. At NovoCure, Mr. Groenhuysen has global responsibility for supply chain, patient experience, information technology, quality, business development and strategy. From 2007 to 2011, Mr. Groenhuysen worked for Cephalon, Inc., a U.S. biopharmaceutical company, last serving as Executive Vice President and Chief Financial Officer, where he had responsibility for worldwide finance, commercial operations and risk management. Prior to joining Cephalon in 2007, Mr. Groenhuysen spent twenty years with Philips Electronics serving various assignments in Europe, Asia and the United States, the latest of which started in 2002 when he was promoted to Chief Financial Officer and Senior Vice President of Philips Electronics North America Corporation. Mr. Groenhuysen holds a Master's Degree in Business Economics from VU University Amsterdam and graduated as a Registered Public Controller at VU University Amsterdam. |

Director since October 2017

| |

| | |

| | Key Attributes, Skills and Experience: Our Nominating and Corporate Governance Committee and our Board of Directors believe that Mr. Groenhuysen's experience as a public company chief operating officer and chief financial officer, his financial acumen and substantial industry experience qualifies him to serve on our Board of Directors. |

| | |

| Sandra L. Helton | | Ms. Helton has served as a director of our company since February 2018. Through May 2022 Ms. Helton served on the Board of Directors of Principal Financial Group (Principal), a global diversified financial institution, where she chaired the Audit Committee and served on Principal’s Executive Committee and Finance Committee, which she previously chaired. Prior to the company going private in October 2022, Ms. Helton also served on the Board of Directors of Covetrus, a worldwide animal health business and chaired their Audit Committee and served on their Nominating and Governance Committee. Prior to the acquisition of Lexmark International Inc. in November 2016, she served on their Board of Directors and Finance and Audit Committee. Ms. Helton also served on the board of Covance Inc., a leading global drug development services company, prior to LabCorp acquiring the company in 2015. She chaired the Finance and Audit Committee and served on the Nominating and Governance Committee of Covance. Ms. Helton was Executive Vice President and Chief Financial Officer, and member of the Board of Directors, of Telephone and Data Systems, Inc. (TDS) from 1998 through 2006. Her responsibilities included strategic planning, finance and information systems, among other functions. Ms. Helton also served on the Boards of United States Cellular Corporation and Aerial Corporation, TDS’s publicly traded subsidiaries. Before TDS, Ms. Helton was Vice President, Corporate Controller of Compaq Computer Corporation. Prior to Compaq, Ms. Helton held over a dozen increasingly responsible positions during her 26-year tenure with Corning Incorporated. Ms. Helton serves on the Board of Northwestern Memorial Foundation. She previously served on the Board of Northwestern Memorial Health Care, a nationally recognized academic medical center, where she chaired the Audit Committee and was a member of the Executive, Finance and Investment Committees. Ms. Helton holds an S.M. in Finance from Massachusetts Institute of Technology’s Sloan School of Management and graduated with a B.S. in Mathematics from the University of Kentucky. |

Director since February 2018

| |

| | |

Optinose - 2024 Proxy Statement | 13

| | | | | | | | |

| | Key Attributes, Skills and Experience: Our Nominating and Corporate Governance Committee and our Board of Directors believe that Ms. Helton’s global executive level experience in a variety of industries, along with her financial and accounting acumen, qualifies her to serve on our Board of Directors and as chair of our Audit Committee. |

| | |

Optinose - 2023 Proxy Statement | 16

| | | | | | | | |

Tomas J. Heyman Director since December 2020

| | Mr. Heyman has served as a director of our company since December 2020. Mr. Heyman held a diverse range of leadership roles across legal, R&D, business development, general corporate management, and equity investments during his thirty-seven-year career with Johnson & Johnson. Most recently, from 2015 to 2019, Mr. Heyman served as president of JJDC, the venture capital group within Johnson & Johnson, where he managed approximately $1.5 billion of capital and oversaw investments in more than 120 companies. Prior to leading JJDC, Mr. Heyman led business development for Johnson & Johnson’s pharmaceutical group, Janssen, for twenty-three years. Mr. Heyman currently serves on the boardBoard of directorsDirectors for Akero Therapeutics, Inc. (NASDAQ: AKRO), a cardio-metabolic biotechnology company, where he chairs Akero’s NominatingCorporate Governance and Corporate GovernanceNominating Committee and is a member of Akero’s Audit Committee; onCommittee (NASDAQ: AKRO), the boardBoard of directorsDirectors of Invivyd, Inc. (formerly Adagio Therapeutics Inc.) (NASDAQ: IVVD), a biopharmaceutical company focused on the discovery, development and commercialization of antibody-based therapies, where he chairs Invivyd'sInvivyd’s Compensation Committee and is a member of Invivyd'sits Audit Committee; on theCommittee (although Mr. Heyman has informed Invivyd that he will not be standing for re-election to Invivyd's board of directors upon conclusion of Xilio Therapeutics, Inc.his term which ends in May 2024) (NASDAQ: XLO)IVVD), a biotechnology company developing tumor-activated immuno-oncology therapies, where he chairs Xilio's Nominating and Corporate Governance Committee and is a memberthe Board of Xilio's Audit Committee; on the board of directorsDirectors of Legend Biotech, Corporation (NASDAQ: LEGN), a biotechnology company developing, manufacturing and commercializing novel therapies to treat life-threatening diseases; ondiseases (NASDAQ: LEGN), the Board of Directors of Xilio Therapeutics, a biotechnology company developing tumor-activated immuno-oncology therapies, where he chairs Xilio’s Corporate Governance and Nominating Committee and is a member of its Audit Committee (although Mr. Heyman has informed Xilio that he will be resigning from Xilio's board of directors at the company's annual meeting of Venatorx Pharmaceuticals,stockholders in June 2024) (NASDAQ : XLO ), and the Board of Directors of Exelixis, a private, clinical-stage pharmaceuticalgenomics-based drug discovery company, where he serves as Non-Executive Chairman.is a member of Exelixis’ Corporate Governance and Nominating Committee and its Risk Committee (NASDAQ :EXEL). Mr. Heyman graduated as Master of Law from the K.U. Leuven in Belgium. He continued with post-graduate studies in International Law in Geneva, Switzerland, and post-graduate studies in business management at the University of Antwerp in Belgium. |

| Director since December 2020 | |

| | |

| | Key Attributes, Skills and Experience: Our Nominating and Corporate Governance Committee and our Board of Directors believe that Mr. Heyman's diverse leadership experience within the pharmaceutical industry qualifies him to serve on our Board of Directors. |

| | |

| Ramy A. Mahmoud, M.D., M.P.H. | | See biography under "Executive Officers and Directors - Executive Officers" above. |

Director since December 2022January 2023

| | |

| | Key Attributes, Skills and Experience: Our Nominating and Corporate Governance Committee and our Board of Directors believe that Mr.Dr. Mahmoud's substantial industry and medical experience and his perspective and history as our former President, Chief Operating Officer, and as our current Chief Executive Officer qualifies him to serve on our Board of Directors. |

| | |

Optinose - 2024 Proxy Statement | 14

| | | | | | | | |